"According to the global Manpower Employment Outlook Survey results released today by Manpower Inc., the fourth quarter of 2009 will continue to challenge job seekers in labor markets around the world, but employer hiring expectations have improved somewhat from three months ago in nearly two thirds of the countries and territories surveyed, suggesting an easing in the pattern of job cuts prevalent for several quarters. Hiring plans are strongest in the emerging markets of India and Brazil, while job prospects remain weak in the United States. However, a greater percentage of U.S. employers expect to keep staff levels unchanged in the quarter ahead, suggesting some stability. Across Europe, hiring sentiments remain generally negative but forecasts have improved in nearly half of the countries compared to the third-quarter forecast."

"Job seekers will still have limited opportunities as our data shows the world's labor markets will not experience recovery in the fourth quarter. The good news is that many markets appear to be heading in the right direction with results from 20 countries and territories showing positive movement from three months ago," said Jeffrey A. Joerres, Chairman and CEO of Manpower Inc. "Interestingly, employers in emerging markets are more optimistic about hiring compared to their counterparts in more developed economies. While a quarter-over-quarter comparison shows modest improvements in six of the G7 countries, with the exception of Canada, all are reporting negative hiring expectations. As demand for their products and services continues to be weak, employers remain very selective in their hiring process, resulting in a sluggish job market."

Employers in 17 of 35 countries and territories surveyed expect some positive hiring activity in the quarter ahead, while those in 15 report negative hiring expectations with 10 reporting their weakest hiring plans since the survey was established. Employers in 31 countries and territories are reporting weaker year-over-year forecasts. Fourth-quarter hiring plans are strongest in India, Brazil, Colombia, Peru, China, Australia, Singapore, Costa Rica, Canada, Taiwan and Poland and weakest in Romania, Spain, Ireland, Japan and Mexico.

Many employers in the 18 countries surveyed in the Europe, Middle East and Africa (EMEA) region continue to report negative hiring expectations for the quarter ahead, with employers in Poland, Norway, Sweden and South Africa reporting the only positive, but slow, hiring activity. However, compared to three months ago, outlooks improved in eight EMEA countries. In contrast, where year-over-year comparisons can be made, hiring intentions are weaker in 15 countries. Job prospects in the region are strongest in Poland and weakest in Romania.

"Eighty percent of employers in Europe are telling us they will make no changes to their staffs, which will most likely lead to some labor market stability in the fourth quarter," said Joerres. "European job seekers in the Manufacturing sector will continue to encounter a difficult market, particularly in Germany, where employers lower their hiring expectations for the sixth consecutive quarter."

Employment prospects have improved in comparison to the third quarter across six of the eight countries and territories surveyed in the Asia Pacific region. However, hiring activity is expected to be slower than historical patterns across the region. Employment prospects are strongest in India, China and Australia with the weakest and only negative outlooks reported in Japan and New Zealand. Compared to 12 months ago, employer hiring expectations are weaker in all countries and territories, most notably in Japan, India and Hong Kong.

"Indian employers have absorbed the layoffs conducted in the third quarter and are telling us they will begin hiring again at a conservative pace, but most intend to keep their workforces intact through the end of the year. Government stimulus efforts around infrastructure projects are contributing to accelerated hiring plans in India's Mining and Construction sector," said Joerres. "Meanwhile, hiring expectations in China are among the most optimistic of the year, with outlooks improving from three months ago across all industry sectors, particularly in the Finance/Insurance/Real Estate and the Services sectors."

Across the nine countries surveyed in the Americas region, hiring expectations have improved from three months ago in all countries with the exception of the U.S. and Mexico, where hiring plans of employers in both countries are at their weakest since Manpower established the survey. On the other hand, year-over-year comparisons reveal weaker hiring activity throughout the region. Manpower surveyed Brazilian employers for the first time this quarter.

"The solid job prospects in Brazil are being bolstered by the Services sector where 37 percent of employers expect to add employees in the quarter ahead. Employer optimism in Canada bounces back into positive territory with the Construction and Finance/Insurance/Real Estate sectors holding the most promise for job seekers," said Joerres. "To the south, the U.S. and Mexican labor markets continue to struggle in tandem, with the majority of employers continuing hiring freezes, opting instead to get work done with the staff they have until conditions improve."

Source: Manpower

------------------------------------------------------------------------------------------------

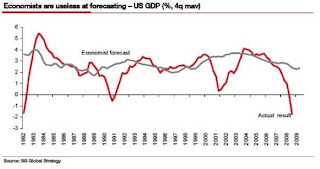

With this report, it shows that Manpower's largest market including France, and the United States have not shown robust growth. Hence, with valuations in question be cautious going forward with this choppy return some stability.

Disclosure: No affiliation with Manpower.