Showing posts with label GDP. Show all posts

Showing posts with label GDP. Show all posts

Thursday, October 29, 2009

Initial Jobless Claims Fell by 1,000 to 530,000; Jobless Benefits Plunged 148,000 to 5.8 Million.

Initial jobless claims fell by 1,000 to 530,000, a smaller drop than predicted by analysts. The total number of people receiving jobless benefits plunged 148,000 to 5.8 million. That's the lowest number of total claims since March, and the biggest weekly drop since July.

Source: Investors

-------------------------------------------------------------------------------------------------

The jobless claims disappointed somewhat with the small marginal drop in weekly claims. However the continuing claims dropped nicely to 5.8 Million. This however maybe due to a larger then expected drop in people's benefits expiring.

Looking ahead next week is the monthly jobs report. This may rise to 9.9%. So even with the better then expected GDP numbers, employment continues to be a lagging indicator of improvement.

The United States continues to add debt to get itself out of this recession, with the auto clunker program, and the first time home buyers tax incentive, without these consumer offers growth would have continued to remain tepid.

Source: Investors

-------------------------------------------------------------------------------------------------

The jobless claims disappointed somewhat with the small marginal drop in weekly claims. However the continuing claims dropped nicely to 5.8 Million. This however maybe due to a larger then expected drop in people's benefits expiring.

Looking ahead next week is the monthly jobs report. This may rise to 9.9%. So even with the better then expected GDP numbers, employment continues to be a lagging indicator of improvement.

The United States continues to add debt to get itself out of this recession, with the auto clunker program, and the first time home buyers tax incentive, without these consumer offers growth would have continued to remain tepid.

Sunday, August 9, 2009

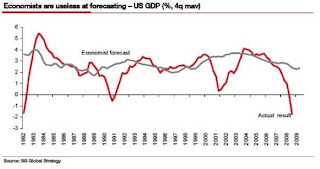

Analyst getting it wrong

Labels:

Bing,

GDP,

Google,

Google Groups,

Investment,

Stock Market,

United States,

Yahoo

Friday, July 31, 2009

GDP First Quarter Revised Down

"U.S. Q1 GDP revised down 6.4% vs -5.5 prev est"

So this morning revision of the United States GDP confirms the drastic decline to the America economy. Consumer spending also was down more then expected during the Q1.

The initial GDP report of -1.0 for the Q2 seems more favorable then expected. However, if this gets revised again, it may not meet the -1.5% that was projected by most economist.

This recession will continue to be drawn out till demand comes back influx with the global economy. Continue to look at labour increasing only when projects, and demand warrant it. Earnings continue to be driven through cost cutting measures rather then revenue growth for most companies.

Labels:

Bing,

Earnings,

GDP,

Google,

Google Groups,

Q1 2009,

Q2 2009,

United States,

Yahoo

Saturday, July 25, 2009

Up, down or back to front in Australia

"THE worst is not behind us. The worst of the global financial crisis has passed and sharemarkets have bounced on signs that the global economic recession is stabilising. But the worst for the Australian economy will come over the next six to nine months as a slump in export prices hits company profits, unemployment rises and consumer spending is checked by a household income squeeze."

I sort of figured that sooner or later all the cash handouts will lead to a decline in spending for future generations. Although, their debt to gdp is low compared to other countries they are very focused on commodities, tourism, financing, and construction. Without these sectors they are as empty in terms of productivity as any developed nation.

So I welcome any reform, especially with the very expensive superannuation plans in Australia. It is a good plan during boom years however with the boom and bust cycle that we have been facing, it can leave a lot of desired effects if there are more busts in the future.

Source: http://www.theaustralian.news.com.au/story/0,25197,25830832-7583,00.html

I sort of figured that sooner or later all the cash handouts will lead to a decline in spending for future generations. Although, their debt to gdp is low compared to other countries they are very focused on commodities, tourism, financing, and construction. Without these sectors they are as empty in terms of productivity as any developed nation.

So I welcome any reform, especially with the very expensive superannuation plans in Australia. It is a good plan during boom years however with the boom and bust cycle that we have been facing, it can leave a lot of desired effects if there are more busts in the future.

Source: http://www.theaustralian.news.com.au/story/0,25197,25830832-7583,00.html

Labels:

Australia,

Bing,

Cash,

Employment,

GDP,

Google,

Google Groups,

Handouts,

Institution,

Investment,

Unemployment,

Yahoo

Subscribe to:

Posts (Atom)