"Stifel Nicolaus analyst James Janesky said in a client note that he views all staffing and employment-related stocks unfavorably "amid continued weakness in the employment market and (we) believe there is potential for our entire ... group to pull back from current levels following the sharp run-up from early-March lows."

"Analyst Ty Govatos of C.L. King & Associates said the stocks could rise twofold or more as business improves in the next two to three years, but he cautioned that his calculations do not include risks that could halt the stocks' climb.

Kelly Services Inc., Manpower Inc. and other staffing companies will likely not perform as well as other companies, though they could still climb between 70 percent and 115 percent, he said in a client note."

Source: AP

Basically, I've been harping on the point that these employment, human resource stocks have been mostly overvalued. With such declines to their revenue and net income compared to the boom present in 2007, there is no way these companies such as Kelly Services and Manpower deserve such multiples.

The multiples that these stocks are trading at are mind blowing considering their businesses have faced tremendous downwards spiral since the 2007 boom.

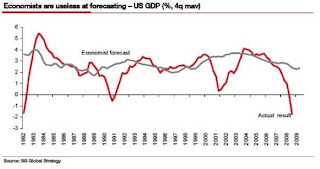

Sales growth, earnings, operating margins have continued to decline and have only stabilized at a bottom. Rather then drive earnings the recent run up has been purely on speculation that we are entering another growth phase. With governmental debt at an all time high, and growth primary coming from government stimulus spending rather then from the private sector, consumers will continue to feel the brunt of this downturn.

End result is low levels of manufacturing. Tepid demand.